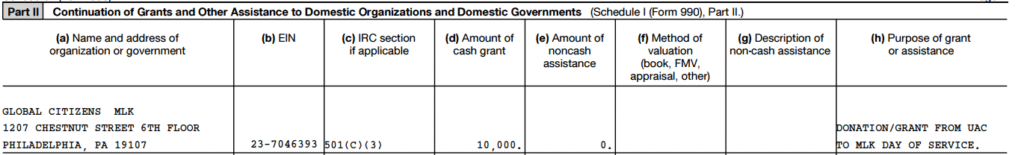

What is going on with UAC paying the Global Citizen 365 President’s salary, Todd Bernstein, as “bonuses?”

An insider is spilling the tea.

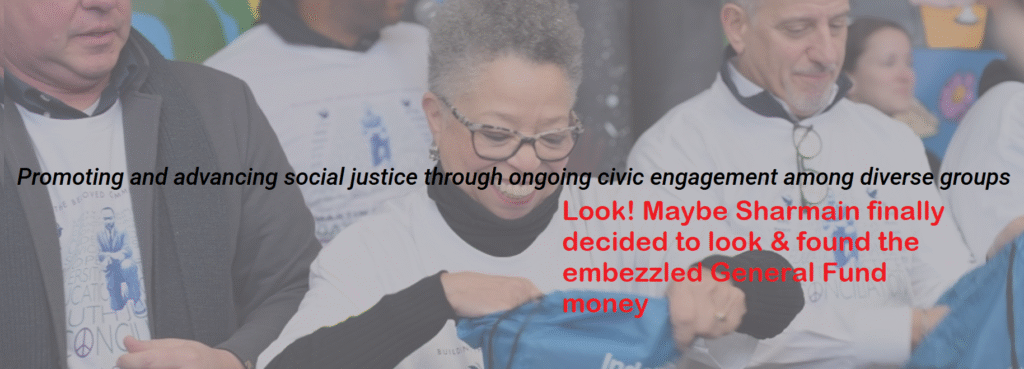

Arun and Sharmain can’t play “not my fault” on these questions.

Sharmain sits on the Board of the United Way.

As a contract programmer for various United Ways since 2006, and an Andar/360 and ENTERPRISE expert, I can attest that United Ways do not play.

United Way of Greater Philadelphia & Southern NJ has 64 employees – I guarantee these are the hardest-working employees in town.

(EIN: 23-1556045)

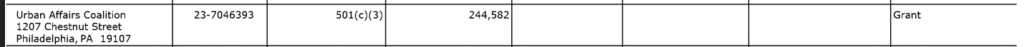

The United Way gave a $244,582 grant to UAC in 2022.

The United Way of Greater Philadelphia & Southern NJ gave Global Citizen $50,000 in 2022.

The Urban Affairs Coalition gives Global Citizen $10,000 grants.

Why does UAC give a grant to itself (same EIN)?

Why is Bernstein’s bonus salary based on grants and donations received?

How can UAC be a fiscal sponsor and a donor to Global Citizen?

I am getting confused.

“While nonprofits can make grants, they cannot typically give grants to themselves because it violates the principle of self-dealing and could raise concerns about conflicts of interest and the proper use of funds.”

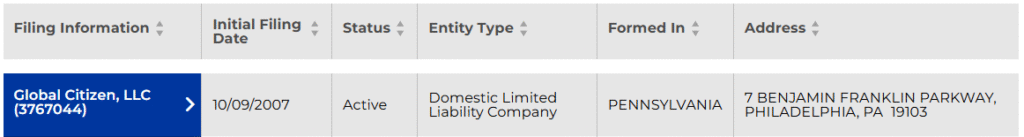

Is this the business filing?

Why does UAC pay Bernstein’s “salary” as “bonuses?”

Does UAC pay any other program partner founder a salary labeled as a bonus?

Who sits on the Global Citizen Board or Advisory Board?

It is no secret that David Brown is his friend.

Is the mayor or a councilman on his Board?

Why does UAC find a way for Global Citizen to pay volunteers with gift cards?

What is a “taxable event”? Stipends or cash gifts of any amount (even allowable “nominal” stipends to bona fide volunteers) are generally taxable income. The volunteer recipient must report the amounts on his or her tax return and pay applicable taxes. And the organization must withhold taxes and make FICA payments – just as it does for employees.

See: Click Here