False Claims Act

For government contractors responsible for tracking time records under government procurement contracts—and for federal grantees responsible for submitting time and effort documentation to their federal funding agencies accurate timekeeping records are crucial.

For a nuclear plant contractor, the submission of false timekeeping entries over a six-year period proved to be far more serious than a simple documentation issue. On Tuesday April 23, 2024 the U.S. Department of Justice (DOJ) announced that Consolidated Nuclear Security LLC (CNS) had agreed to pay $18.4 million to resolve timecard fraud that occurred from 2014 to 2020.

See Story: False Claims Act Settlement

Has UAC self-reported the timecard fraud?

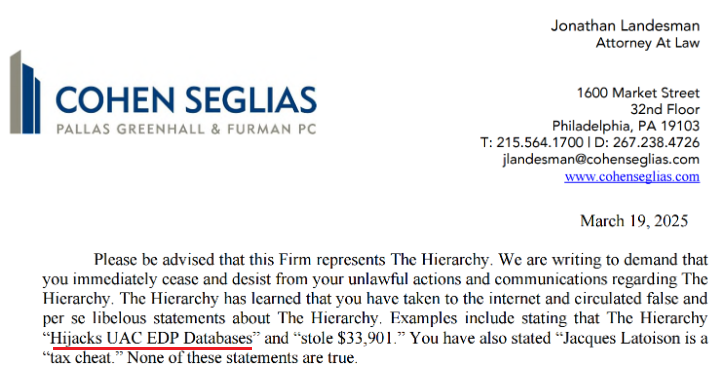

Common sense indicates there is more going on than Milton’s missing paychecks. Stop with the menacing cease-and-desist letters. They are only making the public wonder what MORE you are hiding.

The Timesheet hustle explained

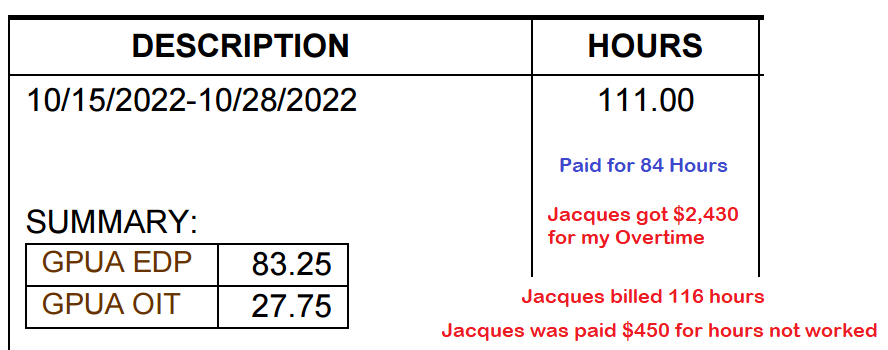

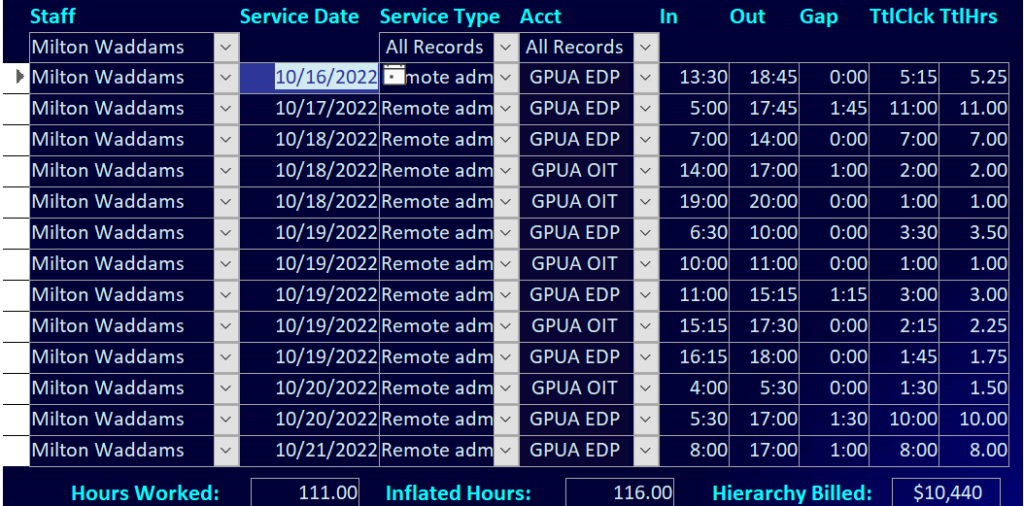

The programmer worked 111 hours between 10/15/2022 and 10/28/2022.

UAC (taxpayers) paid The Hierarchy $10,440.

UAC assured the taxpayers that the programmer was being paid $6,380.

The Hierarchy (taxpayers) paid the programmer $4,620.

UAC assured the taxpayers that 116 hours had been worked.

111 hours were worked; the taxpayers were billed for hours not worked.

Latoison padded to 111 hours up to 116 hours. ($450) for reparations.

The Hierarchy was paid from grant money for hours not worked.

Latoison seized the 27 hours of overtime ($2,430) for reparations.

Grants required the laborer’s name to be on timesheet invoices.

The Hierarchy does not show the laborer’s name.

The Hierarchy does not issue 1099s. This might be because UAC is allegedly billing labor to COTS software.

We now have the grant numbers billed during the victim’s tenure by “Acct” billed.

Jacques Latoison’s profit to push through one 14-day timesheet was $5,820.

How do taxpayers feel that these are taxes deducted from their paychecks, and UAC did nothing to stop the fraud?

UAC is paying a vendor with tax money who is allergic to paying his own taxes!

Let’s see what the grant managers have to say.

A good faith estimate is that “The Hierarchy” has billed $81,155 for hours nobody worked. Why doesn’t anybody care?

See news stories when inflating timesheets did matter. Click Here and Click Here

Falsifying Timesheets for DEI Requirements

The Hierarchy claims that discussing this fraudulent timesheet system, which illegally inflates hours worked reported to and billed to the government grants, is covered under the “Defend Trade Secrets Act (DTSA).” The UAC client list is public record. While Latoison is rocking 11 federal tax liens, reportedly coughing up $1400 on an alleged $300,000 unpaid taxes bill. Good luck with the feds filing a DTSA claim when the programmer has not been paid. The feds have this information, so DTSA them.

Hours for the migration, when the pushy Caucasian reporting to Kevin Swatterhaute, were reportedly billed to the General Fund HHS free-for-all. Labor performed for and directed by Carlos Jones, Urban Affairs Coalition EDP executive, who is ALSO the owner of his private for-profit company, Infinite Economic Development Solutions, was supposedly billed against the PA Department of Community & Economic Development 653 $948,000 cash-in-hand slush fund. UAC knowingly signed invoices for LABOR HOURS in both cases, with Latoison as the programmer. Supposedly, the SQL programmer’s LABOR was recorded as COTS software.

The Hierarchy submits timesheets to the Urban Affairs Coalition (UAC) that omit the name of a Caucasian laborer. Instead, the work is reported under federal grants as being completed by Black workers from “The Hierarchy.” This loophole enables UAC to fulfill its Diversity, Equity, and Inclusion (DEI) goals, while the laborer does not receive a W-2 or 1099 form. In my opinion, UAC ** seems ** to have allowed its staffing company to withhold (Steal) the workers’ pay. Urban Affairs Coalition does not generally report white-collar crime, especially when the victim is white. UAC has a history of not reporting employee theft. An employee even used a company credit card for gambling, Florida vacations, and booze. She never paid UAC (the taxpayers) back for her spending sprees. We are unsure if UAC made the fun-loving employee pay taxes on the stolen income; that would have created a paper trail.

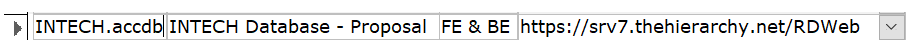

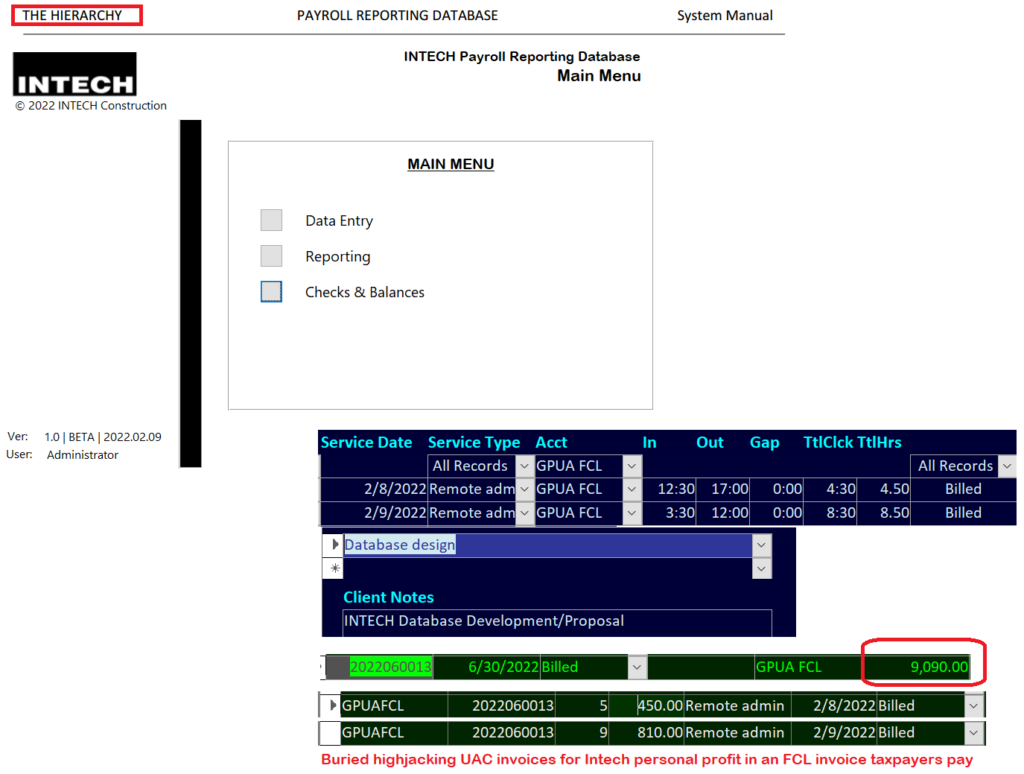

the hierarchy hijacks uac edp databases

Latoison is consistently lying and only creating more problems for himself. He absurdly claims that the databases he hasn’t paid for violate the Defend Trade Secrets Act (DTSA). His only “trade secret” is inflating timesheets on grants without consequences while hiding costs for his personal business. He is hijacking UAC databases by allegedly burying them in larger invoices, which unfairly burdens taxpayers. At the same time, he’s billing contracts for COTS (Commercial Off-The-Shelf) software, which does not constitute “trade secrets.” Cohen Seglias’ assertion that he did not hijack UAC databases for personal gain is outright false. He allegedly concealed the cost of the database within a UAC invoice to FCL that included 25 other items, allowing it to go unnoticed. I was not compensated for this database because he insisted it was for The Hierarchy’s “new business” that I had to support so that he could generate revenue independently from UAC. This manipulation is unacceptable, and it needs to be addressed.

The Jacques Latoison Short Bus Math

See: Click Here

The 7-minute time clock rule is a time-tracking method that rounds employee hours to the nearest quarter-hour increment, as permitted by the Fair Labor Standards Act (FLSA). This rule simplifies the timekeeping process by rounding employees’ clock-in and clock-out times to the nearest 15-minute mark. This means rounding can go up or down to the 15-minute increment.

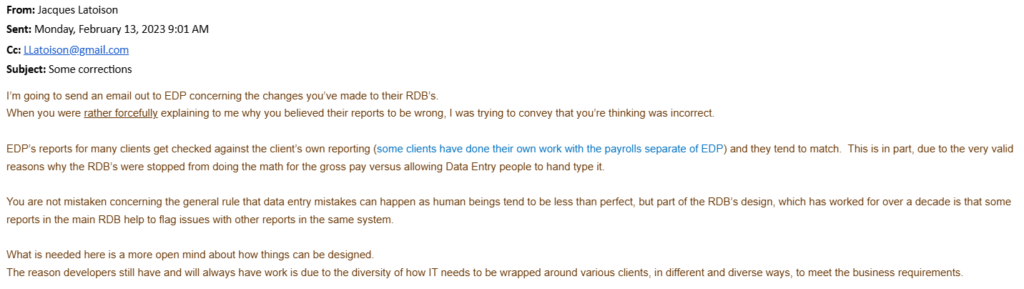

UAC C-Suite management was aware that The Hierarchy intentionally inflates timesheet hours. Latoison rounds time increments up to the nearest full hour. In May 2023, UAC Management was informed that The Hierarchy was misappropriating overtime pay to benefit his company, justifying the act as a form of reparations.

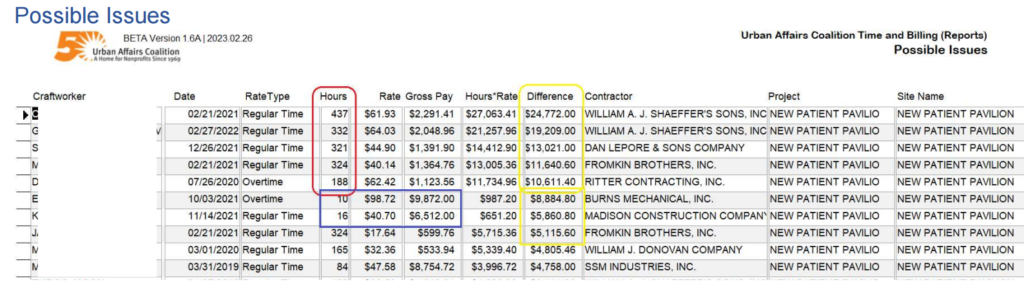

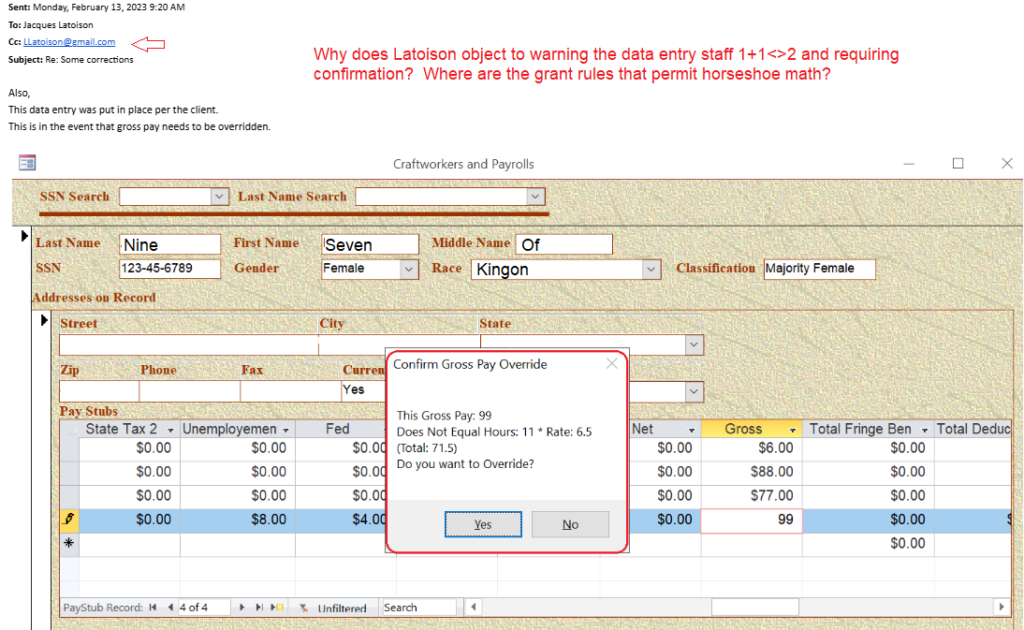

The construction contract gross pay reported on grants is an uncalculated number.

All the grant overseers look at is Gross Pay.

Izzyan Latoison designed the system so UAC could enter in one hour at one dollar and enter $250,000 as the gross pay.

From The Hierarchy’s perspective, [Hours] * [Rate] <> [GrossPay]. 🤡

The issue of inflating hours worked on contracts is further complicated by the Hierarchy’s creation of an “SQL view” named the same as the “Timesheet table.” This change in the front-end ODBC causes the “view” to display instead of the actual table, making it difficult for auditors to identify who is responsible for the inaccurate gross pay data. They have missed the farce for ten years.

Latoison became very upset when these infractions were identified. Jacques seems to suffer from the Mandela Effect; a person suffering from it is physically incapable of admitting a mistake. Jacques claims the programmer “lacks compassion for the minority community.” Latoison admits the falsification of timesheets is intentional and driven by diversity concerns.

Willful Negligence

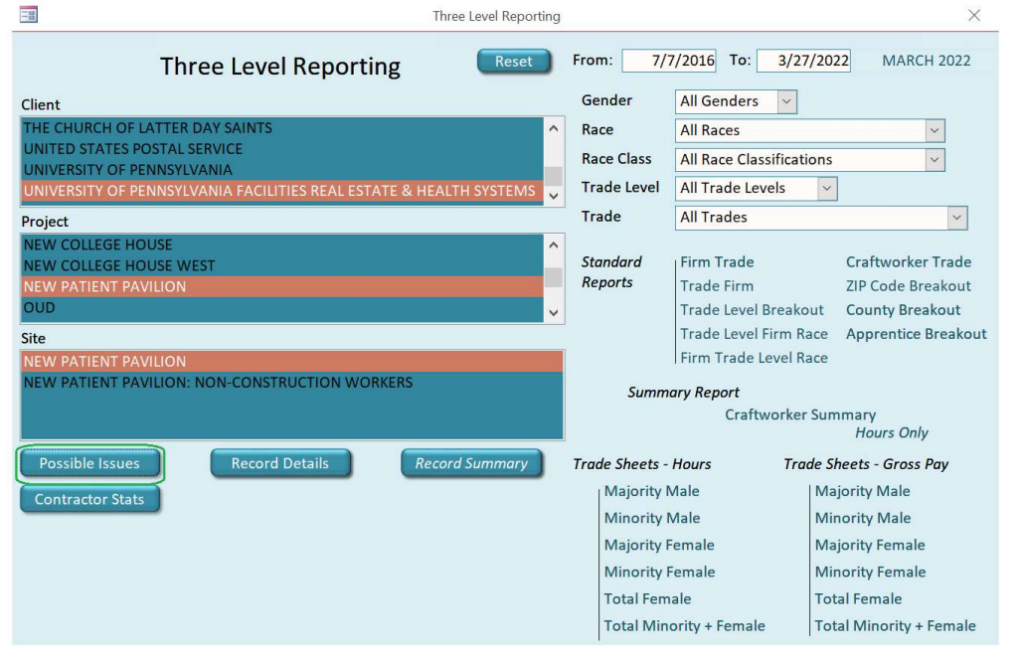

UAC employs a team of workers to manually enter timesheets provided by their DEI construction companies into a Microsoft Access front-end database developed by The Hierarchy, with an SQL Server backend. On my first day, Carlos Jones asked me to review his DEI reports because they were not “adding up”. I noticed that the Gross Pay was being entered manually rather than calculated automatically. Additionally, there were no controls to flag employees who worked more than 8 hours a day or exceeded 24 hours in a single day. I was informed that this lack of control was intentional, as the grants only see the gross pay, and UAC had DEI goals to meet. Since the executive team refused to allow necessary improvements to this flawed system, I implemented a calculated field to flag any discrepancies. This forced the data entry personnel to confirm any intentional overrides. The minor rounding issues are a result of Latoison’s decision to store decimal(19,4) fields as MONEY and his inability to understand it is wrong. He said he and his son-in-law, with selective amnesia, who designed this disaster, went to SQL school for a few weeks.

This is the UAC Government-Required DEI Reports form. The “Possible Issues” pop-up when 1+1 <> 2. The grossly underpaid, off-the-charts intelligent and driven UAC manager, to whom I reported, was stonewalled for years to straighten this out. She had the wisdom to request an audit trail of who was printing which reports to control reports being sent to the projects without her approval. Things got interesting when Latoison started going in the backend, changing gross pay and budgets – the new data entry audit trail implemented showed the goings-on. Why is a tax cheat vendor UAC knows is stealing, changing the DEI financials?

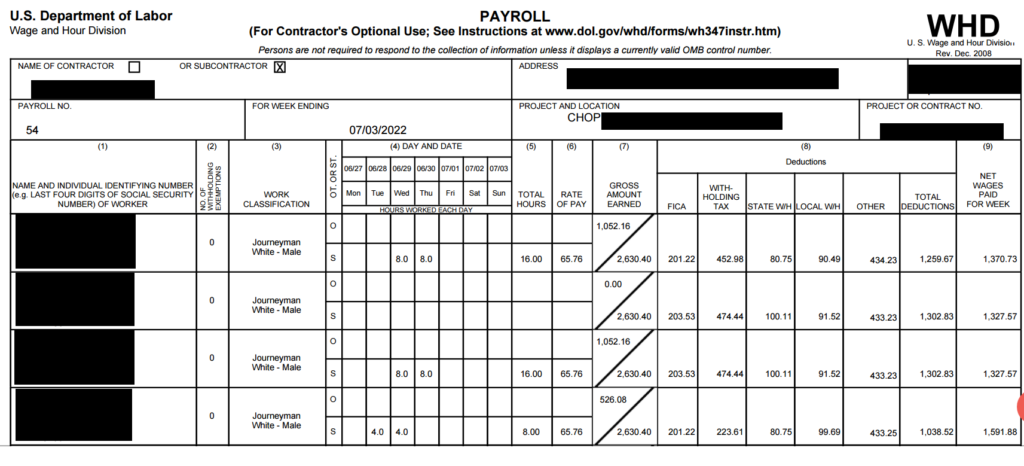

This is an example of the Labor Department timesheets manual re-entered like it is the 1900s by UAC EDP and IEDS staff. The issue is that the gross pay reported to the grants is manually entered, allowing the cost to the taxpayers to be wildly inflated.

To combat this, I created some controls to flag the user during data entry that the gross pay they manually entered does not equal hours x rate. Reports also are not printed, allowing for correction or manual confirmation to override the math. I was nearly fired for this action by Latoison, who called me insubordinate. He phoned me and went batshit 🦇 💩 crazy spewing racist and misogynistic slurs for over 28 minutes.

At this time, my paychecks were 58 days late.

The email receipts….

Using personal emails for government contracts is disturbing.

Latoison admitted that the UAC reports to the federal government use “special math” for minorities where 1+1 does not equal 2. Is it not a coincidence that every deviation results in getting paid more. For ten years dollars have been inflated to give the illusion DEI goals are on target.

Philadelphia Youth Network Intern Pay Issues

UAC admits it intentionally classifies youth labor as a one-time “stipend” payment to avoid paying UAC insurance as employees. The youth enter their hours in the PYNDEX timesheet program, and the UAC CAO uses the General Fund for payroll disguised as a stipend.

Children over twelve (12) years old receive a “PYN WorkReady Visa Payroll Card” debit card. Their paychecks will be deposited onto this card, which can be used wherever debit cards are accepted, including ATMs. Additionally, the youths can transfer funds from their cards directly to a bank account.

(The age limit for payroll cards varies by program, but is usually at least 18 years old.)

Maybe the child will be robbed at the ATM, bullied into sharing their card, buy adult items online, or withdraw cash to buy crack. Endless possibilities!

Stipends to Avoid Being Covered by UAC

Ask Chanice Smith at NOMO for a sampling of how Arun handled some of the youth whose parents had to beg for their kids to be paid. Would Arun like it if one of his kids worked for six weeks and did not get a paycheck? I think not.

There will be no payroll deductions. Since they are not on UAC’s payroll. They will need to complete a W9 form to be issued a check.

You do not want them on UAC payroll because it will cause them to be covered by UAC insurances as employees.

Since the funds being issued are from UAC general fund, UAC should treat the payment as a one-time stipend payment which is done for other programs and requires w9 form be completed and signed.

See: Philadelphia Youth Payment Problems